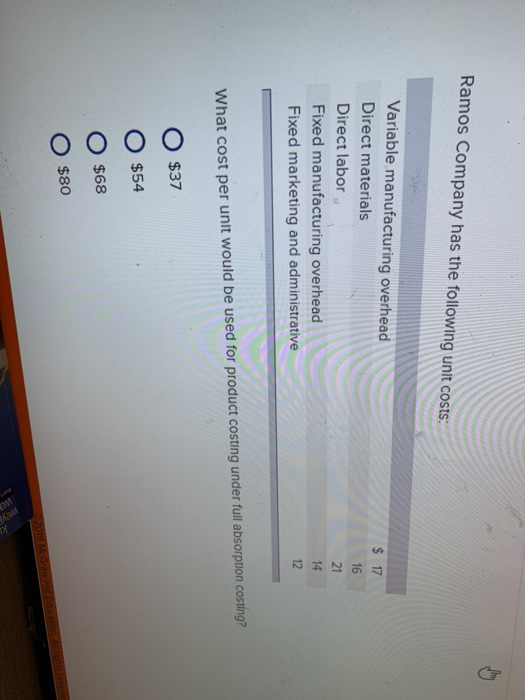

View the full answer. Ramos Company has the following unit costs Variable manufacturing overhead Direct materials Direct labor Fixed manufacturing overhead Fixed marketing and administrative What cost per unit would be used for product costing under full absorption costing.

Solved Ramos Company Has The Following Unit Costs Variable Chegg Com

We eagerly look forward to working with you and making your vision a reality.

. 39 Product cost per unit under V View the full answer Transcribed image text. Start a Project View Popular Projects Back. Variable manufacturing overhead 13 Direct materials 12 Direct labor 17 Fixed manufacturing overhead 10 Fixed.

Activity setting up equipment ordering cost machine costs. Variable manufacturing overhead 13 Direct materials 12 Direct labor 17 Fixed manufacturing overhead 10 Fixed marketing and administrative 8 What cost per unit would be used for product costing under variable costing. Ramos Company has the following unit costs.

100 1 rating Unit product costDirect mater. Ramos company has identified the following overhead activities costs and activity drivers for the coming year. 29 42 52 60 13 12 17 42.

Ramos Company has the following unit costs. 76 VMODMDLFMO1918231676 76 VMODMDLFMO1918231676. Variable manufacturing overhead 19 Direct materials 18 Direct labor 23 Fixed manufacturing overhead 16 Fixed marketing and administrative 14 What cost per unit would be used for product costing under full absorption costing.

Ramos Company has the following unit costs. Treadmill Elliptical Trainer Sales price per unit 300 175 Variable cost per unit 160 85 Total demand for the Treadmill product is 7000 units and for the Elliptical Trainer product is 5000 units. Variable manufacturing overhead 13 Direct materials 12 Direct labor 17 Fixed manufacturing overhead 10 Fixed marketing and administrative 8 What cost per unit would be used for product costing under full absorption costing.

It has developed the following per unit standard costs for 2014 for each item. Our depth of knowledge and experience solidify our belief that customer service stands as the highest priority. In 2014 the company expected to produce 20 000 units of Product XYZ and planned a level of 60000 hours of direct labor.

The Ramos Company manufactures two products. The Ramos Company makes Product XYZ. Receiving expected cost 120000 90000 210000 activity driver number of setups number of orders machine hours receiving hours activity capacity 300 9 9000 21000 5000.

Ramos Company has the following unit costs. Variable manufacturing overhead 13 Direct materials 12 Direct labor 17 Fixed manufacturing overhead 10 Fixed marketing and administrative 8 What cost per unit would be used for product costing under variable costing. F Company makes a product with the following standard costs.

Variable manufacturing overhead 13 Direct materials 12 Direct labor 17 Fixed manufacturing overhead 10 Fixed marketing and administrative 8 What cost per unit would be used for product costing under variable costing. 1 Variable manufacturing overhead Direct materials Direct labor Fixed manufacturing overhead Fixed marketing and administrative 12 11 16 9 7 What cost per unit would be used for product costs under variable costing. Ramos Company has the following unit costs.

Welcome to RAMOS CONCRETE. Ramos Company has the following unit costs. Ramos Company has the following unit costs.

Ramos Company has the following unit costs. Variable manufacturing overhead 16 Direct materials 14 Direct labor 18 Fixed manufacturing overhead. 9 Ramos Company has the following unit costs.

Variable manufacturing overhead15 Direct materials 13 Direct labor 17 Fixed manufacturing overhead 12 Fixed marketing and administrative 11 What cost per unit would be used for product costs under full absorption costing. Treadmills and Elliptical Trainers. We proudly provide the highest quality of service and craftsmanship for each aspect of your project.

Standard Quantity Standard Cost Standard Cost per Unit Direct materials 71 pounds 500 per pound 3550 Direct labor 8 hours 1700 per hour 1360 Variable overhead 8 hours 700 per hour 560 Fixed overhead 8 hours 900 per hour 720. Ramos Company has the following unit costs. O O 37 54 O 68 O 80 EE.

Ramos Remodeling LLC HomeAdvisor prescreened Addition Remodeling Contractors Disability Service Contractors in Reading PA. In Business Since 1972. The costs and revenues are as follows.

Variable manufacturing overhead 17 Direct materials 16 Direct labor 21 Fixed manufacturing overhead 14 Fixed marketing and.

Acct3032sol47 Pdf 239 Award 1 00 Point Vegas Company Has The Following Unit Costs Variable Manufacturing Overhead Direct Materials Direct Course Hero

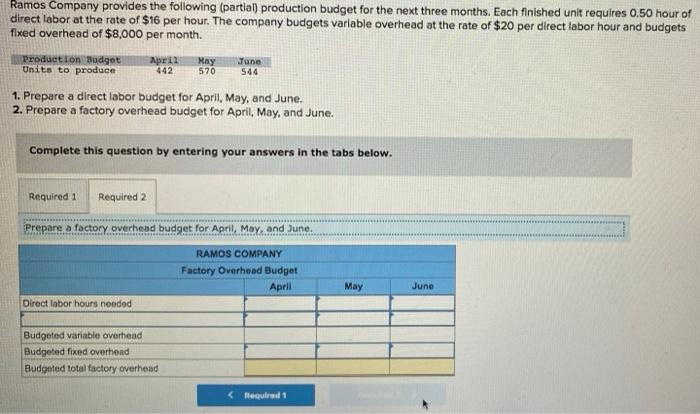

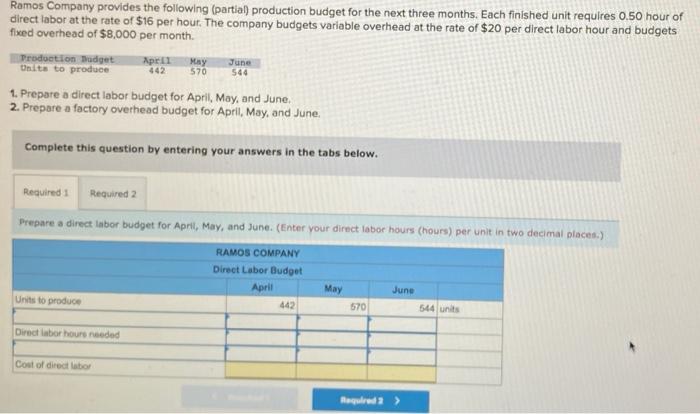

Solved Ramos Company Provides The Following Partial Chegg Com

Solved Ramos Company Provides The Following Partial Chegg Com

Acct3032sol43 Pdf 223 Award 1 00 Point The Estimated Unit Costs For A Company To Produce And Sell A Product At A Level Of 12 000 Units Per Month Are Course Hero

0 Comments